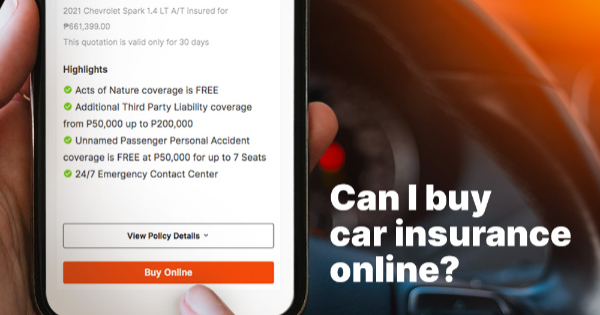

Car Insurance Online

If you are among the individuals that are used to finding cheap car insurance using the old ways, maybe it’s time to change your approach. The best way to buy car insurance online and the lowest annual car insurance rates is to shop around and compare car insurance quotes.

The most effective way to get detailed offers quickly and conveniently is online shopping. If you are considering renewing your current car insurance or are looking for new car insurance companies and are feeling reasonably comfortable shopping online, 9JaGistreel.Com will show you how to get started.

How Do I Buy A Policy Through An Insurance Company’s Website?

There are countless car insurance companies that operate nationwide and even more that offer insurance for specific regions or areas. While finding the best and cheapest car insurance coverage is a crucial step for you, it’s also important to keep your search manageable. Our ranking of the best car insurance and cheapest car insurance can help you figure out which companies are most likely to meet your needs with competitive insurance rates, so you can start there when you’re ready to start looking for car insurance quotes.

Every motorist who is looking for new insurance coverage should find out more. For each insurer on your list, the company’s online quoting tool will ask for the zip code, age, and driver’s license number of the drivers in your household, Information about the vehicles your household owns or plans to purchase (such as year, make, model, and VIN); and driving data for each member of your household. These questions provide insight into the formulas insurance companies use to create quotes and set car insurance rates, so the process will be similar for every insurer you’re considering.

Also keep in mind that most insurance companies offer various discounts, e.g. the combination with rental insurance or a discount for the purchase of a new car. While you can get an idea of the discounts available by researching each website, these discounts may not be included in your first online offer.

It is also helpful to know what type of insurance coverage is included in your current policy and for what amount, e.g. Third Party Insurance, Uninsured Motorist Insurance, Collision Damage Waiver, Collision Insurance, and other supplementary insurance. You don’t want to be swayed by a supposedly cheap premium and realize too late that this is far less insurance coverage than you had before.

Can I Buy Car Insurance Through Other Websites?

Some car insurance websites allow you to enter your personal information and get multiple quotes at the same time. While there is nowhere you can buy quotes for car insurance – online, over the phone, or in person – without sharing relevant information.

However, with the help of quote comparison tools, you can quickly and easily see quotes from multiple insurers by sharing your personal information. If you’re interested in the quickest way to compare quotes or want to make sure all your bases are covered, quote comparison sites are a great tool and can direct you straight to the cheapest company for you so you can configure your new policy.

Pros and cons of buying car insurance online

Pros

- You can easily get quotes online at any time.

- Online quotes are fast and can only take a few minutes.

- Online-only policies can be cheaper because there are no brokerage fees or commissions.

Cons

- Online quotes can be confusing if you’re not tech-savvy or unfamiliar with car insurance.

- Quotes are estimates only based on limited information and your actual car insurance rates may vary.

FAQs

What do I need to buy car insurance online?

Online quotation tools require the following information: age, driver’s license number, driving history, and address of each member of your household; the make, model, and VIN of each car in your household; and information about your current car insurance.

Before you start your online purchase, you should make sure that you have gathered all the necessary information. This will make the process smoother and produce more accurate car insurance quotes.

Here is the information you need:

- Basic information, including the name, address, and date of birth of each driver on your policy

- Driving license information for each driver in the policy

- Driving history for each driver under the policy, including completed driver safety courses, traffic violations, and at-fault accidents

- Vehicle information including year, make, model, current mileage, and vehicle identification number

- Current insurer (if any) and current coverage limits

To find out your driving history, visit your state’s automotive website. Usually, you can download and print your driving history by paying a small fee e.g. $2 in California and $8 in Massachusetts and Florida.

How can I save money by buying car insurance online?

The important key to saving money when buying new car insurance online is to do your research. Compare offers and browse all available discounts to find the cheapest rates. Our ranking of the cheapest car insurance companies can help you figure out where to start, and our car insurance buying guide can help you figure out how much coverage you need so you don’t over- or under-buy what can be very expensive for you in the long run. While minimum coverage may be the cheapest insurance policy, an add-on such as supplemental liability insurance, personal injury insurance, or even collision damage waiver can help you save money in the event of an accident.

What is the best way to get car insurance online?

Shopping on every side is the best way to find new car insurance policies online. That means comparing offers to find out which company can offer you the best insurance coverage at a competitive price. You can also see the extent to which insurers adjust rates, insurance quotes, and premiums based on factors such as discounts, sums insured, and deductibles.

What options do I have if I don’t want to take out car insurance online?

How do I find a car insurance agent online?

Most car insurance company websites have a directory that puts you in touch with a local insurance agent. This way you can contact the broker in the way that suits you best. In general, there are two types of agents:

- Captive Agent: This type of agent only sells policies from a specific insurance company or group of affiliated insurers.

- Independent Agents: This type of agent works with a variety of auto insurance companies.

It’s a good idea to speak to an independent insurance broker who can get multiple quotes from different insurance companies.

How do you decide how to get car insurance?

If you’re thinking about buying car insurance online but aren’t sure if this is the right choice for you, that’s totally fine! You can always start researching companies and even compare quotes on social media before committing. If you are not happy with the process, you can always change gears and get your new policy over the phone or at a local agent’s office.

Tips for saving money when buying car insurance online

Perhaps the biggest advantage of buying car insurance online is the convenience factor, but it’s also a great way to save money. Even if you already have car insurance, it’s worth getting quotes to see if you can find a better deal elsewhere. According to a recent Forbes Advisor survey, more than half (58%) of drivers feel they are paying too much for car insurance, but only 29% have switched companies.

Here are some tips to keep in mind when buying car insurance online:

- Compare offers: Don’t settle for the first offer you find on social media. Comparing car insurance quotes from multiple insurance companies is the best way to save money.

- Look for discounts: Insurance companies offer a wide range of discounts and savings can vary from insurer to insurer. For example, our analysis of car insurance discounts found that discounts for good drivers can range from 10% to 40%.

- Group your policies: With bundling, two different types of insurance are insured with the same insurance company. For example, bundled discounts for car and home insurance can range from 5% to 25%.

- Increase your deductible: Your car insurance deductible is the amount that will be deducted from your insurance check when you make a claim under certain types of insurance (e.g. collision or computable damage waiver). Deductibles generally range from $250 to $1,000 (or more). In general, a higher deductible results in lower premium payments.

- Be selective about optional coverage for older cars: In some cases, it doesn’t make sense to buy certain types of optional insurance for an older vehicle, such as comprehensive insurance and collision insurance. If you’re not sure what to buy, there’s no harm in picking up the phone and speaking to an independent insurance agent.

How much does car insurance cost?

According to a Forbes Advisor analysis of car insurance rates among bigger insurance companies, the average cost of auto insurance nationwide is $1,569 per year. However, their rates depend on several factors.

Car insurance premium factors include:

- Your driving report

- The driving records of all drivers in your policy

- Your vehicle

- Where you live

- Your age and driving experience

- Your claims history

- Your choice of car insurance coverage

- Your car insurance deductible

- Your credit-based insurance score (except in California, Hawaii, Massachusetts, and Michigan)

- Other factors such as marital status, home ownership, gender, and occupation

Which companies have the cheapest car insurance?

USAA has the cheapest auto insurance, but this is only available to military personnel, veterans, and their family members. If you don’t have USAA auto insurance available, it’s worth getting a quote from Geico.

But don’t stop there. It’s a good idea to take advantage of the wide range of offers available to you. As you will see below, car insurance prices can vary widely depending on the company.

Here is an overview of the best cheap car insurance companies, according to a Forbes Advisor analysis of car insurance rates. (Read Here)